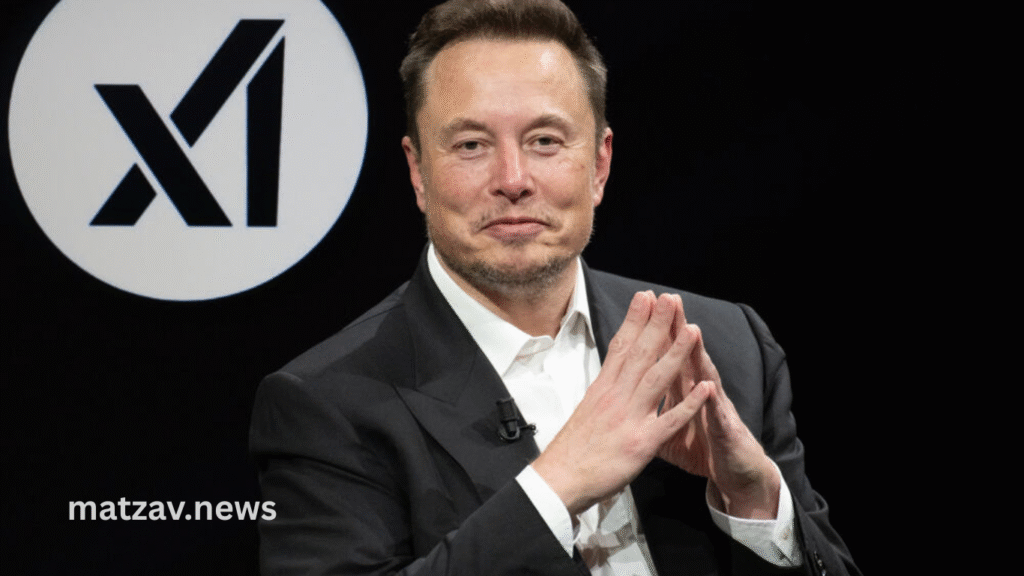

A high-profile dispute has erupted between an investor closely linked to Elon Musk and one of the world’s largest asset management firms. This clash is grabbing attention in the financial world due to its potential implications for shareholder influence, corporate governance, and investment strategies. The parties involved are notable players, making this disagreement especially significant in the context of high-stakes investing and market dynamics.

At the heart of this conflict lies a debate over control and strategic direction within a significant publicly traded company. The disagreement highlights the rising tensions between activist investors with strong personalities and traditional institutional asset managers who often advocate for steady, long-term growth. As this battle unfolds, it could reshape how major shareholders assert their power in corporate decision-making processes.

Background of the Investor Connected to Elon Musk

The Investor’s Profile and Relationship with Elon Musk

The investor involved in this dispute has earned a reputation for bold moves and high-profile investments. Known to have ties with Elon Musk, this figure is seen as an influential player capable of shaking up boardrooms. Their connection with Musk has often been a subject of media attention, especially as Musk himself commands a significant following and influence in the tech and investment sectors.

Previous Investment Moves and Market Impact

Historically, this Musk-tied investor has engaged in aggressive investment strategies aimed at pushing companies toward rapid innovation and strategic shifts. Their involvement often signals a potential for disruptive changes, which has made them both admired and controversial within the investment community. These moves frequently cause volatility in markets but can lead to long-term gains for shareholders who back their vision.

Profile of the Asset Manager

Overview of the World’s Biggest Asset Manager

The opposing party is one of the largest asset management firms globally, managing trillions in assets. This institution is known for its conservative investment philosophy, emphasizing sustainable growth, governance, and risk management. Its role in the global financial system is critical, as it holds significant stakes in numerous multinational corporations.

Investment Philosophy and Corporate Governance Approach

Unlike activist investors, this asset manager typically prioritizes stability and long-term shareholder value. It advocates for balanced risk and often collaborates with corporate boards to ensure steady growth and compliance with regulations. Its approach to governance is structured, preferring dialogue and gradual changes rather than confrontational tactics.

Core Issues Behind the Clash

Disagreements Over Corporate Strategy

Central to the clash are conflicting visions for the company’s future. The Musk-linked investor is pushing for swift, transformative changes, possibly including leadership shake-ups or shifts in business models. In contrast, the asset manager favors a cautious approach that safeguards existing business lines and incremental innovation.

Influence on Board Composition and Voting Rights

Another flashpoint involves control over the company’s board of directors. Both parties seek to place their preferred candidates to sway key decisions. The battle over voting power and proxy fights has intensified, reflecting broader tensions about shareholder democracy and power balance.

Impact on Stock Performance and Market Sentiment

Market watchers are closely monitoring how this dispute influences the company’s stock price. Volatility has increased amid uncertainty, affecting investor confidence. Analysts are debating whether this clash will ultimately add value by forcing positive change or create instability detrimental to all shareholders.

Broader Implications for Investors and the Market

Activist Investors vs. Institutional Managers

This case exemplifies the growing divide between activist investors and large institutional managers. The former often champions rapid innovation and disruptive strategies, while the latter emphasizes risk management and stability. This dynamic is shaping investment trends and corporate governance globally.

Corporate Governance Trends in 2025

The dispute highlights ongoing shifts in governance, with increased shareholder activism and demands for transparency. Companies are under pressure to balance competing shareholder interests and adapt to evolving regulatory landscapes.

Potential Regulatory and Legal Considerations

Legal experts note that such high-profile conflicts may invite regulatory scrutiny, especially regarding disclosure, proxy voting rules, and fiduciary duties. Future regulations could be influenced by outcomes from cases like this, aiming to protect shareholder rights and market integrity.

Responses From the Parties Involved

Statement from the Musk-Tied Investor

The Musk-associated investor has publicly emphasized their commitment to driving innovation and unlocking shareholder value. They assert that bold leadership changes and strategic pivots are essential for long-term success.

Reaction of the Asset Manager

The asset management firm has responded by highlighting the importance of prudent governance and protecting the interests of all shareholders. They express concerns about destabilizing actions that may harm the company’s reputation and financial health.

Industry Analysts’ Perspectives

Financial analysts are divided. Some support the activist’s push for change, while others warn about potential risks of upheaval. The consensus is that the outcome will set important precedents for future shareholder engagements.

Potential Outcomes and Market Impact

Possible Scenarios for Resolution

The dispute could end through negotiated settlements, proxy battles, or even legal challenges. Each scenario carries different implications for the company’s future and shareholder value.

Implications for Shareholders

Shareholders must weigh the benefits of transformative change against the risks of instability. The case underscores the importance of active engagement and informed voting in corporate decisions.

Effects on Related Markets and Sectors

This conflict may influence investor behavior across technology and finance sectors, potentially encouraging more activism or fostering calls for greater institutional oversight.

Frequently Asked Questions

Who is the investor linked to Elon Musk who is involved in this clash?

The investor is a prominent figure known for activist strategies and close ties with Elon Musk, aiming to drive rapid corporate changes.

What asset management firm is involved?

One of the world’s largest asset managers, managing trillions of dollars, is known for its conservative and steady investment approach.

Why is there a dispute between these two parties?

The disagreement centers on differing visions for corporate strategy, governance, and control of board seats.

How does this clash affect the company’s stock price?

It has caused increased volatility and uncertainty, impacting investor confidence in the short term.

Who is the most significant investment manager according to assets under management?

BlackRock is the most significant investment manager globally, with over $10 trillion in assets under management (AUM).

Who are the most significant asset managers by market cap?

BlackRock and Vanguard Group typically lead the rankings among publicly traded asset managers.

What does this mean for other investors?

It signals the growing power struggle between activist investors and traditional institutional managers.

Could this dispute lead to regulatory changes?

Yes, regulators may revisit rules on shareholder voting and disclosure due to high-profile conflicts like this.

How might the company’s leadership change?

There could be boardroom shake-ups depending on proxy battles and shareholder votes.

What should shareholders do in this situation?

Shareholders should stay informed, participate in voting, and consider the long-term impact of the dispute.

Conclusion

The clash between the Musk-linked investor and a significant asset manager highlights evolving tensions in corporate governance. As both parties vie for control, the dispute underscores the delicate balance between innovation and stability in today’s markets. Its outcome will influence shareholder activism and asset management strategies globally.