Market Jitters After Trump’s Comments on Strong Dollar

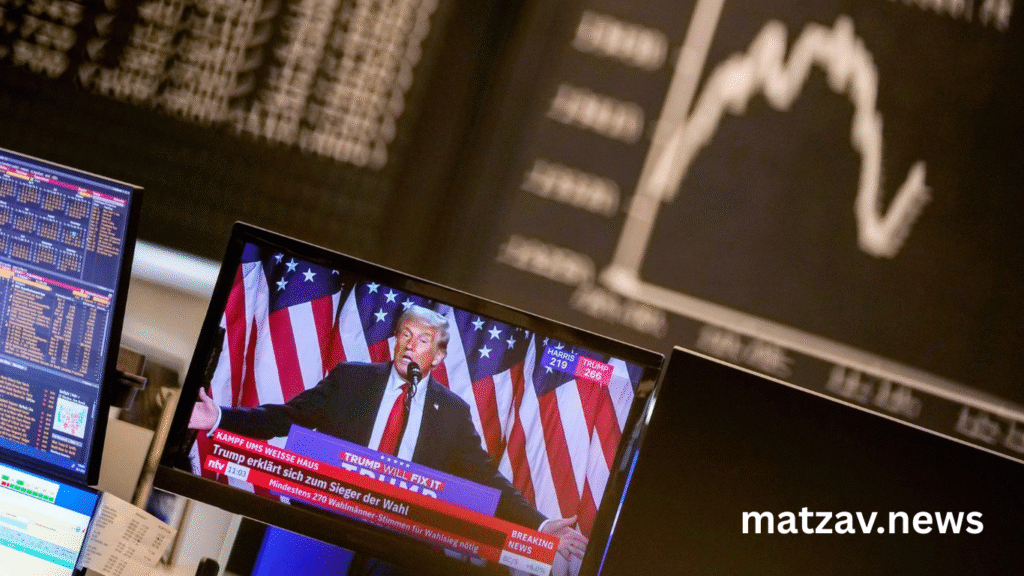

U.S. stocks dropped, and the dollar plunged to its lowest level in three years after President Donald Trump criticized the dollar’s strength. This move surprised investors and shook financial markets.

Speaking at the World Economic Forum in Davos, Switzerland, President Trump stated that the dollar is “too strong,” contradicting earlier statements from Treasury Secretary Steven Mnuchin. The comments triggered an immediate reaction across global markets.

Dollar Weakens Sharply Against Major Currencies

Following Trump’s remarks, the U.S. dollar tumbled against a basket of major currencies. The U.S. Dollar Index, which measures the dollar’s value against six major currencies, fell to its lowest point .

The euro soared past the $1.25 mark, hitting levels not seen in over three years. Meanwhile, the British pound and Japanese yen also strengthened against the greenback.

Markets Shake After Unexpected Comments From Trump

Financial markets were rattled after President Donald Trump made unexpected remarks about the strength of the U.S. dollar. His comments, delivered at the World Economic Forum in Davos, clashed with earlier signals from his administration and sparked a sharp sell-off in both the dollar and U.S. stocks.

Investors had already been on edge due to rising bond yields and speculation about future interest rate hikes. Trump’s comments added a fresh layer of uncertainty, sending shockwaves through global markets.

Trump Says Dollar Is “Too Strong”

During an interview in Davos, President Trump said the U.S. dollar was “too strong,” a statement that seemed to contradict the long-held view that a strong dollar reflects economic strength. This surprising shift in tone confused traders and raised questions about the administration’s actual currency policy.

These comments were wildly unexpected because they came just a day after Treasury Secretary Steven Mnuchin expressed support for a weaker dollar. Mnuchin had told reporters that a softer dollar was good for U.S. trade, signaling a potential shift in U.S. economic strategy.

Dollar Falls to Lowest Level

The U.S. Dollar Index, which measures the dollar’s value against six major world currencies, dropped significantly after Trump’s statement. It hit its lowest level in more than three years, falling below key technical support levels.

Currencies such as the euro, British pound, and Japanese yen all gained ground. The euro, in particular, surged above $1.25 for the first time since 2014, benefiting from both the dollar’s weakness and renewed confidence in the European economy.

Impact on U.S. Stock Markets

U.S. equities quickly reacted to the dollar’s plunge. The Dow Jones Industrial Average fell over 100 points, while the S&P 500 and Nasdaq also slipped from recent highs. The declines ended a streak of strong performances that had fueled investor optimism since the start of the year.

Market analysts noted that while a weaker dollar can help multinational companies earn revenue overseas, the sudden drop caused broader concerns about policy stability and global market confidence.

Investors Caught Off Guard by Mixed Signals

The contrast between Trump’s comments and those of Mnuchin just one day prior left investors scratching their heads. Markets typically rely on consistent messaging from top officials, especially when it comes to currency policy, which can influence global trade and capital flows.

The mixed signals created confusion and led many investors to adopt a more cautious approach, pulling back from riskier assets in favor of safer investments like gold and U.S. Treasury bonds.

Global Ripple Effects

The dollar’s weakness had ripple effects across global markets. European stocks were mixed, with export-heavy industries getting a boost from the euro’s strength. Meanwhile, Asian markets showed increased volatility as currency values shifted and investor sentiment wavered.

Commodity prices also moved. Gold prices rose as investors sought out safe-haven assets amid uncertainty. Oil prices climbed slightly, benefiting from the weaker dollar, which typically makes commodities more affordable to foreign buyers.

Why a Weak Dollar Matters

A weaker dollar can benefit U.S. exporters by making American goods more affordable overseas. However, it can also raise concerns about inflation and reduce the purchasing power of American consumers and travelers.

Wall Street Reacts: Major Indexes Take a Hit

U.S. stock markets reacted negatively to the sudden currency fluctuations. The Dow Jones Industrial Average dipped over 100 points during the trading session, and the S&P 500 and Nasdaq also fell, ending a multi-day winning streak.

Investors were already on edge due to rising bond yields and worries about potential interest rate hikes from the Federal Reserve. Trump’s comments added a layer of uncertainty that markets weren’t prepared for.

Trump vs. Mnuchin: Mixed Signals on Currency Policy

What added to the confusion was the contrast between President Trump’s remarks and those of Treasury Secretary Mnuchin just a day earlier. Mnuchin had welcomed a weaker dollar, saying it was “good for trade,” which initially pushed the currency down.

Trump’s comments appeared to reverse that message, saying, “The dollar is going to get stronger and stronger, and ultimately, I want to see a strong dollar.” This back-and-forth left traders unsure about the administration’s actual stance on the dollar.

Global Impact: Ripple Effects Across Markets

The dollar’s drop had global consequences. European and Asian markets were mixed, with exporters in Europe benefiting from the weak dollar, while Asian markets showed volatility.

Gold prices surged as investors flocked to safe-haven assets. Oil prices also edged higher, thanks to the weaker dollar, which tends to boost commodity prices.

What This Means for Investors

Market volatility is expected to continue as investors navigate Washington’s mixed messages. Currency fluctuations, trade tensions, and interest rate speculation are likely to dominate headlines in the coming weeks.

Key takeaway: For investors, now’s a good time to stay informed, consider portfolio diversification, and be prepared for potential short-term turbulence in both the stock and currency markets.

Frequently Asked Questions

Why did U.S. stocks fall after Trump’s comments?

Stocks dropped due to uncertainty and volatility triggered by Trump’s unexpected remarks on the strength of the U.S. dollar.

What did Trump say about the dollar?

President Trump said the dollar is “too strong,” causing confusion and contrasting earlier statements by his Treasury Secretary.

How did the market react to Trump’s dollar comments?

The dollar dropped sharply, and major stock indices like the Dow, S&P 500, and Nasdaq saw declines.

What is the U.S. Dollar Index?

The U.S. Dollar Index measures the value of the dollar against a basket of six major world currencies.

Why does a weaker dollar matter to investors?

It impacts global trade, commodity prices, inflation, and the purchasing power of U.S. consumers and investors.

How does a weak dollar affect exports?

A weak dollar makes U.S. exports cheaper and more competitive in global markets, benefiting American exporters.

What was Mnuchin’s view on the dollar?

Treasury Secretary Mnuchin supported a weaker dollar, saying it benefits U.S. trade and economic growth.

How do Trump and Mnuchin’s views differ?

Mnuchin welcomed a weak dollar, while Trump contradicted him later by expressing support for a stronger currency.

How did global markets respond?

European and Asian markets were mixed, with some gains in export-driven sectors and increased volatility overall.

What should investors do during this market uncertainty?

Investors should stay informed, diversify their portfolios, and prepare for short-term market swings.

Conclusion

Trump’s unexpected remarks on the U.S. dollar sent shockwaves through global markets, triggering a stock sell-off and weakening the currency. This event highlights how political comments can disrupt financial markets and investor confidence. For traders and long-term investors alike, staying updated on geopolitical developments and maintaining a balanced portfolio is key to navigating uncertain times in a rapidly changing global economy.